The Electric Car Market: Online Consumer Behaviour

It has been a year since the team at Autoweb Design undertook fundamental market research into the factors that influence consumer decisions to buy an electric car from a dealership when looking at their website. We presented the findings of this research and subsequent quantitative research at the EV Retailing Summit in Birmingham last October. Those findings generated a great deal of debate.

Electric car sales have been through a turbulent time recently, and we decided to recap the research findings and look again at where car retailers should go with their online strategy for this small but important segment of car buyers.

Whilst it is not the core business of a dealership now, making sure that they can get a foothold in the electric vehicle market that is likely to grow is important as overall market share could be increasingly determined by the volume of electric vehicle sales, with an increase in consumer demand/adoption of EVs.

The Initial Interview-Based Research

The trouble with starting research like this with surveys is that you must make assumptions about what consumers value. We wanted to work from the foundations and listen to what consumers said without pushing them to discuss one idea. This initial 'qualitative' research aimed to understand how UK consumers decide to buy electric cars using websites so that we could ultimately work out what a dealership could do with their website to capture more electric car buyers. The study used interviews and a research method called Grounded Theory to create a model for future research. It had limitations due to its qualitative approach but aimed to contribute to understanding EV adoption in the UK.

We interviewed UK drivers, avoiding participants from within the automotive industry. Interviews happened in various ways, like face-to-face, phone, email, and text. We asked participants about their car-buying experiences, preferences, and what factors influenced their decisions, especially about EVs. The main thing was that the interviews were not fully structured; questions were open-ended and only introduced if there was a break in response to the broadest introductory question, so participants were free to raise any thoughts or topics that came to mind.

The interviews were analysed using Grounded Theory methodology, and they stopped when no new ideas were being found in further interviews. This approach contrasts with other techniques with a fixed number of interviews. It, of course, will cover only some factors that influence buying. Still, it gives a solid basis for developing a conceptual model for this research. When we say ideas, these are abstract topics or themes that are coded based on what they have in common and then grouped according to the research method (grounded theory methodology) to develop concepts, as you will see below.

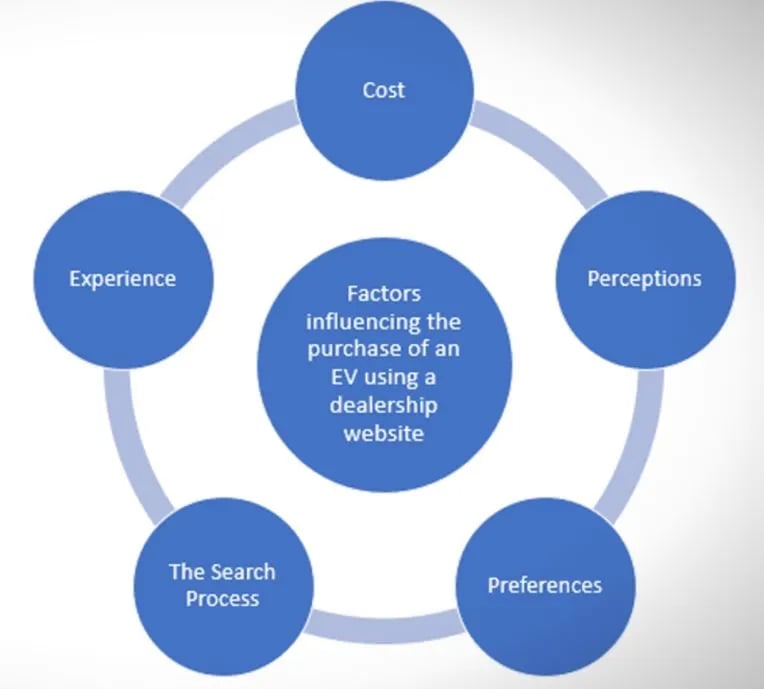

The concepts developed through the research fit into five main categories, all centred around a core idea. The categories were "Cost," "Perceptions," "Preferences," "Experience," and "The Search Process."

Category Details

- Cost: Most participants cared about the cost of buying an electric car. Some discussed the costs of using EVs versus traditional cars, wanting clear comparisons.

- Perceptions: People had different opinions about EVs. Some were doubtful due to things like range and charging issues (of course, range anxiety is a commonly used term nowadays). Others saw EVs as the future but pointed out infrastructure problems (e.g. public charging points). The critical thing is that there were existing perceptions; some people are optimistic about EVs, and some are negative.

- Preferences: People's behaviour may be influenced by how they want to buy (e.g. PCP finance, leasing) or which car they want. Some knew precisely what they wanted, while others explored options within their budget or other parameters.

- Experience: Some participants had previous experience with electric vehicles. Negative experiences with EVs' range and ownership appeared to make some people avoid electric cars. A bad experience of buying cars online was also noted.

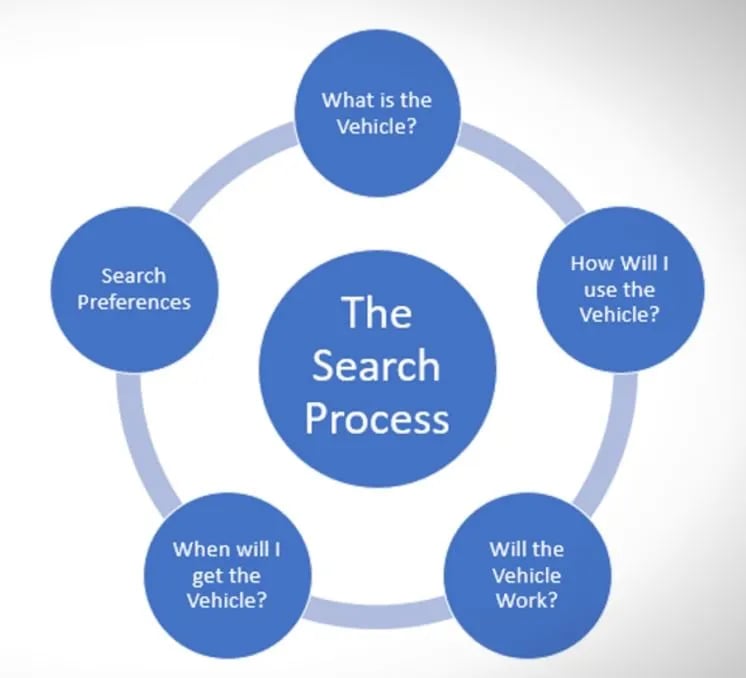

- The Search Process: This category included sub-categories like "What is the Vehicle?", "How Will I use the Vehicle?", "When Will I Get It?" and "Search Preferences." People wanted clear information about EV options with things like charging and delivery times, as well as a wide range of electric models. Some preferred online searches, while others liked visiting dealerships.

Qualitative Research Findings

The research brought to like ideas not fully exposed within the existing research literature that was reviewed but also meshed quite nicely with what had already been done. You can get your copy of the entire research paper here.

The research proposed a model of influencing factors that could be used as the basis for future research, particularly the 'quantitative' research that we did next.

The Consumer Survey

We surveyed 300 UK drivers who said they would consider an electric car for their next vehicle. The reason for this screening question was that the research discussed above brought to mind the idea that some consumers will consider an EV and others won't. Perhaps those who won't have negative perceptions for various reasons, including experiences, the point is that they exist.

Whether it is for a dealership, governing bodies or automotive manufacturers to change these perceptions is debatable. Still, the remaining research focused on finding actionable insights for dealerships who want to capture more consumers who would consider an electric car. After all, EVs are still only a part of what dealerships need to focus on, and you must continue doing what is required to service bread-and-butter demand. Switching attention away from internal combustion engine cars at this time isn't viable. People want and own petrol and diesel cars. With all that said, here is what we learned about the consumers who could be in the market for an electric vehicle.

Question Set

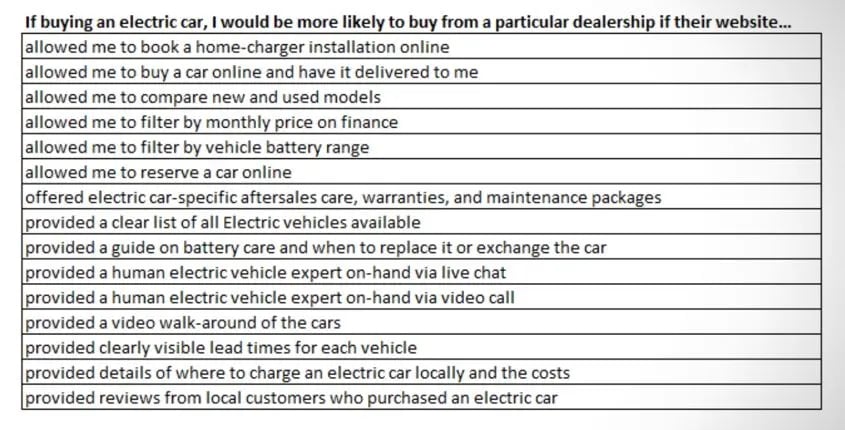

15 Questions were put forward, with the participant rating each one on a 7-point Linkert scale ranging from Strongly Disagree to Strongly Agree. The first part of the question is shown in bold below for ease of presentation, but the survey respondents saw the whole question each time.

Participants

300 UK Participants who answered "Yes" to the following question: "Would you consider buying an electric car for your next car?". As seen from the charts below, a spread of demographics was covered.

Validity

The survey data had a Cronbach Alpha score of 0.828 – A good level of internal consistency.

Outcome of the Survey Analysis

Because the features being asked about were all, on the face of it, quite sensible things to offer on a website, it was no great surprise that the responses were more balanced towards the positive end of the scale. You can see this in the line graph below. One of the first things we wanted to check was whether or not participants were answering all of the questions similarly, in which case there may be a problem with the data. However, we found very little correlation between the responses to questions by participants, so we could proceed.

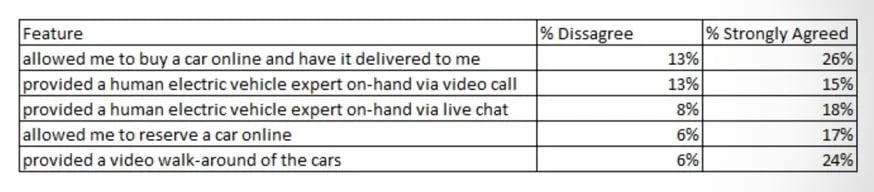

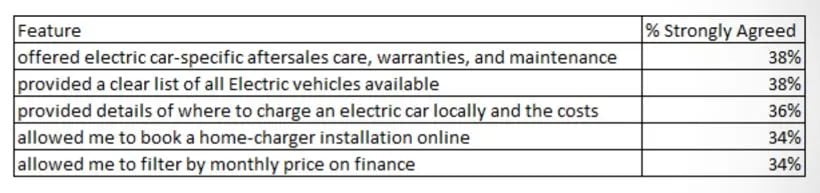

Because of the generally positive sentiment about the questions, we grouped the disagree and strongly disagree categories together and looked at the strongly agreed class separately. This approach would allow us to put forward what we felt were the survey's key findings, which are shown below.

Top Disagreed

In contrast to the following results, the strongly disagreed answers were quite polarising. A significant portion of participants strongly agreed with the same statements. These statements seem to reflect the division among consumers between those who like to buy online or use a website as part of the car-buying journey and those who prefer dealership visits and face-to-face interaction. This point is essential to note. As an industry, we must recognise that both types of consumers exist in meaningful quantities; going all-in with online purchasing will alienate a significant segment of consumers, whereas another part will appreciate this functionality.

Top Strongly Agreed

To identify a top 5 action list for a dealership's website, we looked at the most strongly agreed with statements shown below. These point to things like electric-car-specific servicing, warranty, availability and usage information. These findings are not surprising when you consider the adjustments needed to switch to driving a car driven by an electric motor with battery power. Questions over the ongoing maintenance requirements and lifespan of lithium-ion batteries are surely fundamental considerations in a significant purchase like a car. It would be expected that providing answers to these questions would be critical to unlocking demand for EVs and, more broadly, EV sales growth.

A key takeaway from this leading into the successful case study shown below was that this consumer segment wants an electric-car-specific online journey, essentially an electric car dealership website. The user journey is sufficiently different in its informational requirements and options that it justifies its own focus. With that said, converting an entire dealer group website to focus on electric vehicles will shift too much focus from the ICE car buyers, as noted previously. This situation raises the case for microsites, something we have been very successful in implementing. Some of the results are shown in the case study. As a fast way to tailor a solution to this niche consumer base, it has to be a consideration for retailers offering electric cars. As demand for EVs grows, this provides a basis for more fundamental shifts in strategy.

Case Study

We launched an EV Microsite for a franchise car dealership for this case study. This microsite had a sole focus on electric car sales and EV servicing.

Dealership Website Content

The website featured a range of used electric cars in stock, with vehicle listings and detail pages highlighting EV-specific features such as charge-time and battery range rather than the traditional specifications shown on dealership websites for petrol and diesel cars like transmission and fuel-efficiency/mpg. The website also provided localised and national information on public charging points, as well as information on home charging and how to arrange installation. An electric car servicing section was also added, providing information on the technical training required for technicians and the servicing preparation that the consumer needs to know about (for example, charging the car ahead of the service). Essentially, this case study utilised the research above as a blueprint and combined it with website design disciplines (including UI and UX) to produce a solution for a dealership to increase electric car sales.

The Results

Starting with a new domain, having no visibility in Google, the website achieved a number one ranking position within the first three months for several important keywords, including "used electric cars" + Location, "electric cars" + Location and "electric cars in" + Location, bringing in significant amounts of organic search traffic.

Furthermore, the traffic that came to the website converted into good-quality sales leads. Because the website journey was tailored in the way suggested by our research, it achieved a conversion rate of over 4%, somewhere between 2x and 4x the conversion rate seen on a general dealership website. Between the conversion rate and the traffic being brought in from Google and other search engines, the website was a sales generator created from a standing start for an underserviced consumer base.

This case study and our low-cost, quick-to-deploy EV microsite offering demonstrates the creative and data-driven approach to innovation that we adopt, innovation being one of our core company values.